What Are Blockchain Bridges & How Do They Work?

Discover how blockchain bridges work, their types, benefits, risks, and why they are crucial for the future of Web3 in this comprehensive guide.

The blockchain universe is vast, with various networks like Ethereum, Binance Smart Chain, Solana, and Avalanche existing as separate ecosystems. Each has its unique tokens, protocols, and features, which makes the idea of transferring assets between these chains a challenge.

Have you ever wondered why you can't just move your ETH directly from Ethereum to Solana? It's because blockchains operate in silos—designed to be secure but isolated from each other.

Blockchain bridges solves this. It breaks down these barriers and creates pathways for seamless asset and data transfer across different chains. Whether you're a developer, trader, or DeFi enthusiast, understanding blockchain bridges is crucial for navigating the increasingly interconnected world of DeFi.

In this detailed guide, we’ll explore how blockchain bridges work, their types, benefits, risks, and why they are essential for the future of Web3.

What Are Blockchain Bridges?

Blockchain bridges are the essential connectors that enable seamless asset and data transfers between different blockchain ecosystems. Picture each blockchain as an independent island—its native assets cannot be transferred to another island. A blockchain bridge acts as the ferry that transports goods (tokens or data) from one island to another, fostering an interconnected network.

Why Are Blockchain Bridges Important?

Blockchains, by their nature, operate as isolated networks with unique rules and assets. For instance, moving tokens from Avalanche to Solana isn't natively possible due to their distinct protocols. This limitation hampers interoperability, slowing down the overall growth of the blockchain ecosystem. Blockchain bridges address this issue by breaking down silos and enabling smooth cross-chain transactions, effectively expanding the potential of blockchain technology.

Secure Your Smart Contracts with QuillAudits

Ready to secure your smart contracts? Take the first step towards a safer blockchain journey. Request an Audit with QuillAudits today & ensure your contracts are robust and secure!

How Do Blockchain Bridges Work?

There are 5 primary mechanisms through which blockchain bridges operate.

Wrapped Asset Method

The Wrapped Asset Method is one of the most prevalent mechanisms used by blockchain bridges. It allows assets to be transferred between blockchains by creating a "wrapped" version of the asset on the destination chain.

Here's a detailed breakdown of the process:

- Locking the Original Asset: When a user wants to transfer an asset from Blockchain A to Blockchain B, the original asset is sent to a smart contract on Blockchain A, where it gets locked. This smart contract serves as the custodian, ensuring that the asset remains secure throughout the transfer process.

- Minting the Wrapped Asset: Once the asset is locked, the bridge mints an equivalent amount of a "wrapped" version of the asset on Blockchain B. This wrapped token is pegged 1:1 to the original asset, maintaining its value. For example, if 1 SOL is locked on Solana, 1 Wrapped SOL (wSOL) is minted on Ethereum.

- Transacting with Wrapped Assets: The wrapped asset can now be used on the target blockchain just like any native token. Users can trade, stake, or utilize it within decentralized applications (dApps) on Blockchain B.

- Redeeming the Original Asset: When a user wants to transfer the asset back to the original chain, the wrapped token is sent to the bridge, where it gets burned. The smart contract then releases the equivalent amount of the original asset from its custody on Blockchain A.

Advantages:

- Allows seamless asset transfer between blockchains.

- Maintains a 1:1 value peg, ensuring users don’t lose value during the transfer.

Disadvantages:

- The security of this method relies on the smart contract and the bridge’s custodian mechanism. If compromised, locked assets could be at risk.

- Centralization concerns arise if a single entity controls the locking and minting process.

Liquidity Pool Method

The Liquidity Pool Method involves pre-funded pools of assets on both participating blockchains, allowing for instantaneous asset transfers without needing to mint wrapped tokens.

Here’s how this method works:

- Setting Up Liquidity Pools: The bridge maintains liquidity pools on both Blockchains A and B, containing assets for immediate swapping. These pools are funded by liquidity providers who deposit their assets in exchange for earning transaction fees or other incentives.

- Asset Transfer Process: When a user wants to transfer an asset from Blockchain A to Blockchain B, the bridge deducts the equivalent amount from the pool on Blockchain A and immediately provides the user with the corresponding asset from the pool on Blockchain B. This direct swap mechanism ensures a swift transfer without the need for locking or minting.

- Maintaining Pool Balance: Over time, liquidity pools need to be balanced. To incentivize liquidity providers to keep pools adequately funded, the bridge offers rewards, such as interest payments or governance tokens.

Advantages:

- Provides faster and more efficient transfers compared to the wrapped asset method.

- No need for minting or burning tokens, reducing complexity.

Disadvantages:

- Requires a constant supply of liquidity, making it dependent on liquidity providers.

- Can face challenges in maintaining pool balance, especially during high-demand periods or market volatility.

The Liquidity Pool Method is widely used by bridges aiming for high-speed and cost-effective transfers, especially when dealing with frequent cross-chain interactions. However, maintaining liquidity and ensuring security remain the primary challenges for this approach.

State Channel Bridges

State channels act as an off-chain scaling solution that allows multiple parties to perform numerous transactions outside of the main blockchain network. This approach helps alleviate congestion on the main chain and significantly reduces transaction costs. The process involves locking assets in a multi-signature smart contract on the main blockchain, which opens a temporary communication channel between participants.

- Opening the Channel: To initiate a state channel bridge, the participating parties first lock a certain amount of assets in a smart contract on the main chain. This contract holds the assets in escrow and establishes the conditions for the state channel.

- Off-Chain Transactions: Once the channel is open, participants can perform unlimited transactions off-chain. These transactions are not immediately recorded on the blockchain, allowing for rapid, low-cost transfers. Each party signs off on each transaction within the channel, ensuring mutual agreement.

- Closing the Channel: When the participants are done transacting, they submit the final state of their transactions to the main blockchain. The smart contract verifies the last agreed-upon balance and updates the blockchain accordingly.

Advantages:

- State channels enable near-instantaneous transactions, as the main blockchain only processes the final state rather than each individual transaction.

- Reduces the burden on the main chain, minimizing gas fees and enhancing scalability.

Disadvantages:

- State channels are only effective for participants who intend to conduct multiple transactions over time. For single transactions or interactions involving many parties, this method becomes less practical.

- Assets must remain locked in the smart contract while the state channel is open, which might be inconvenient if participants need liquidity elsewhere.

- If disputes arise during the channel's operation, settling them on-chain can be complex and expensive, potentially nullifying the cost benefits of using a state channel.

Atomic Swap Bridges

Atomic swap bridges enable cross-chain asset exchanges directly between users, without the need for an intermediary or centralized exchange. The process utilizes smart contracts with Hashed TimeLock Contracts (HTLCs) to ensure the swap either completes successfully or reverts if any party fails to fulfill the contract terms.

- How It Works: Atomic swaps involve creating a smart contract that includes a hashlock and a timelock:

- The hashlock ensures that a secret key (hash preimage) is required to unlock the funds.

- The timelock sets a deadline for completing the transaction, ensuring that funds are returned to their original owners if the swap isn't completed within the specified time.

- The hashlock ensures that a secret key (hash preimage) is required to unlock the funds.

- Execution: When two parties want to swap assets between different blockchains, one party locks their asset in an HTLC contract using a secret key. The other party, in turn, locks their asset using the same hashlock. The exchange completes only when both parties reveal the secret key, ensuring a trustless swap.

Advantages:

- The use of HTLCs ensures that both parties either complete the transaction or revert to their original state, providing a secure, trustless environment for cross-chain swaps.

- Eliminates the need for third-party involvement, reducing the chances of fraud or manipulation.

Disadvantages:

- Atomic swaps require a certain level of technical expertise, making them less accessible to non-technical users.

- Not all blockchains natively support the smart contract capabilities necessary for HTLCs, restricting the scope of this method's applicability.

- Although secure, the process can be slow due to the reliance on blockchain confirmation times, especially when dealing with networks that have longer block times.

Relayer Bridges

Relayer bridges use a network of independent validators, called relayers, to facilitate cross-chain communication and transactions. These relayers monitor events on one blockchain, validate them, and relay the information to another blockchain, ensuring seamless interoperability between chains.

- How It Works: When a transaction occurs on Blockchain A, the relayer network validates the transaction and forwards the relevant data to Blockchain B. Depending on the bridge protocol, this information can be verified through multi-signature or threshold signature schemes, ensuring that multiple relayers reach consensus before the transaction is approved.

- Securing the Transfer: Relayer bridges often utilize incentive mechanisms to encourage honest behavior among relayers. In many cases, relayers are required to stake tokens as collateral, which can be slashed if they attempt to act maliciously or relay incorrect information.

Advantages:

- Relayer bridges are effective for transferring both simple assets and complex data across multiple blockchains.

- The relayer network ensures that transactions are validated in real time, maintaining the integrity and consistency of cross-chain communications.

Disadvantages:

- If a small group of relayers gains control over the network, it can undermine the decentralized nature of the bridge, leading to potential manipulation.

- Relayer bridges can be susceptible to attacks if relayers act maliciously or collude, especially if the consensus mechanism is weak.

- Maintaining and incentivizing an extensive network of relayers can be costly, and these expenses are often passed on to users in the form of fees.

What Types of Blockchain Bridges Exist?

Blockchain bridges can be broadly categorized into three types: Trusted Bridges, Trustless Bridges, and Hybrid Bridges.

Trusted Bridges

Trusted bridges, also known as federated or custodial bridges, are managed by a centralized authority or a consortium of entities responsible for validating and approving transactions. This central entity serves as the gatekeeper for the transfer process, controlling the locking, minting, and release of assets.

How They Work: When a user wants to transfer assets across chains, they deposit their tokens into a smart contract controlled by the central authority. The bridge then issues a corresponding wrapped asset on the destination chain. The reverse process occurs when the user wishes to redeem their assets back to the original chain.

Advantages:

- Speed and Efficiency: Due to centralized management, transactions are processed quickly and with minimal friction.

- Lower Fees: Centralization allows for reduced operational costs, often resulting in lower fees for users.

Disadvantages:

- Centralization Risk: Since the bridge relies on a central authority, users must trust this entity not to compromise or mishandle their assets.

- Single Point of Failure: If the managing entity is compromised, hacked, or becomes insolvent, users' funds could be at risk.

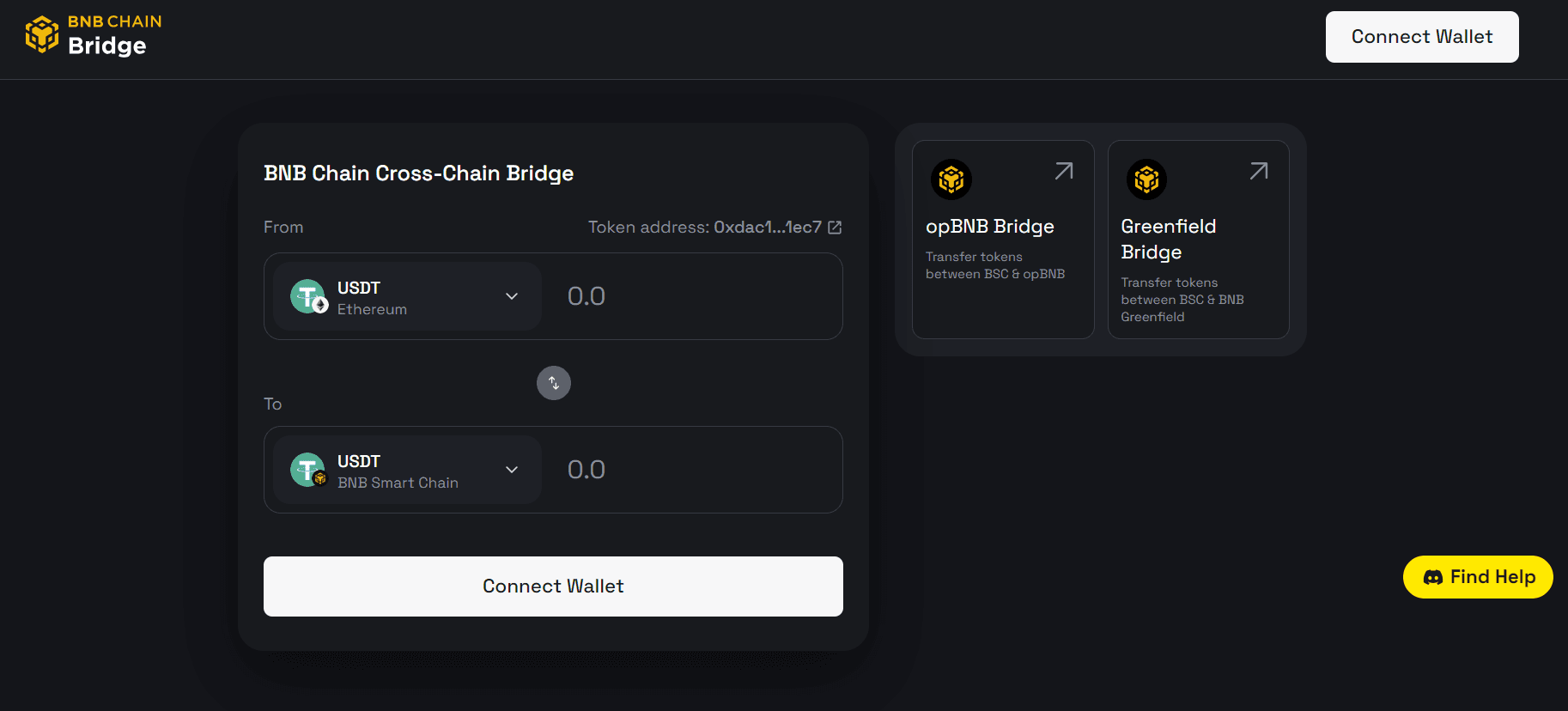

Binance Bridge, which facilitates asset transfers between Binance Smart Chain (BSC) and other blockchains, is a widely known trusted bridge. Users place trust in Binance as the custodian of their assets during the transfer.

Trustless Bridges

Trustless bridges, also referred to as decentralized bridges, operate using smart contracts, cryptographic algorithms, and decentralized validators, eliminating the need for a central authority. These bridges align closely with blockchain's core principles of decentralization, transparency, and security.

How They Work: Trustless bridges employ smart contracts to lock assets on the originating blockchain and mint equivalent tokens on the destination blockchain without human intervention. Validators, or nodes, across the network collectively verify transactions, ensuring that no single entity controls the process.

Advantages:

- Enhanced Security: With decentralized validation, trustless bridges mitigate the risks of fraud, hacking, or mismanagement by a central authority.

- Transparency: The use of smart contracts ensures that all transactions are publicly recorded and verifiable, fostering transparency.

Disadvantages:

- Slower Speeds: Due to the decentralized validation process, transaction times may be slower than trusted bridges.

- Higher Fees: The decentralized nature often results in higher gas fees, as multiple nodes participate in verifying transactions.

RenBridge and Polkadot's cross-chain communication model exemplify trustless bridges, allowing for asset and data transfers without reliance on a single party.

Hybrid Bridges

Hybrid bridges blend aspects of both trusted and trustless bridges, aiming to balance the benefits of centralization (speed and low fees) with the security and transparency of decentralization. These bridges might employ centralized validators or gatekeepers but settle transactions through decentralized consensus mechanisms.

How They Work: Hybrid bridges typically use a semi-centralized system to manage transaction initiation, while the settlement and finalization occur through a decentralized process. For example, a hybrid bridge might utilize a trusted validator network to initiate transfers but use smart contracts to complete the process.

Advantages:

- Balance of Speed and Security: By combining centralized management with decentralized settlement, hybrid bridges achieve faster transactions while maintaining security and transparency.

- Flexibility: Users can enjoy the benefits of both trusted and trustless systems, depending on their preferences or risk appetite.

Disadvantages:

- Complexity: The dual nature of hybrid bridges can make them more complex, requiring users to understand both centralized and decentralized elements.

- Potential Centralization Risk: Although more secure than purely trusted bridges, hybrid bridges still involve some level of centralization, introducing potential vulnerabilities.

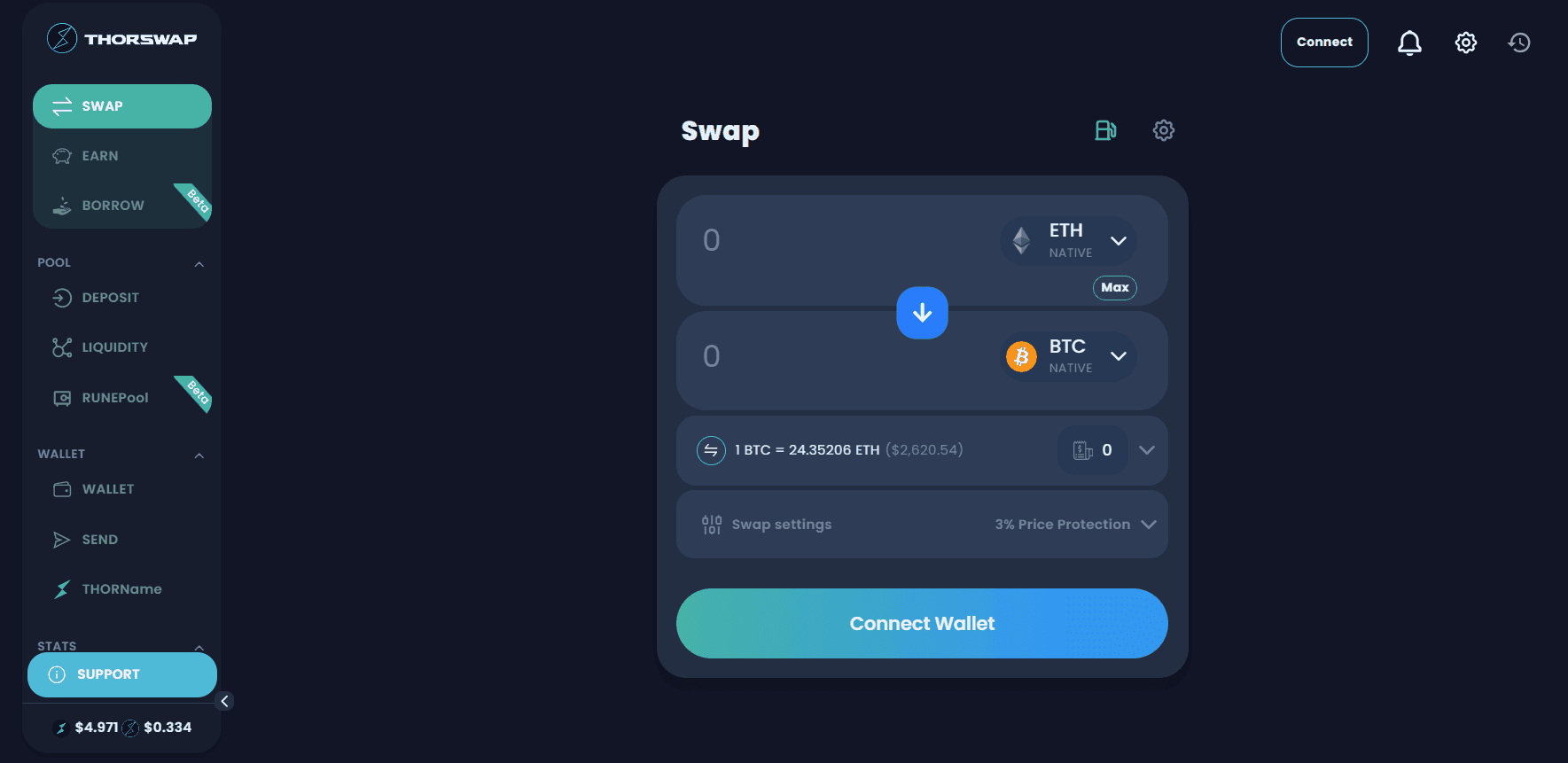

Thorchain and Chainlink’s Cross-Chain Interoperability Protocol (CCIP) are examples of hybrid bridges, offering a mix of centralized coordination and decentralized settlement.

What Are the Common Use Cases for Blockchain Bridges?

- Transferring Crypto Across Chains: Bridges enable users to move assets seamlessly between different blockchains, such as swapping ETH from Ethereum to WBTC on the Bitcoin network.

- Accessing dApps Across Ecosystems: Different blockchains have unique decentralized applications (dApps). Bridges allow users to explore these ecosystems without needing to convert their assets.

- Lower Transaction Costs: Cross-chain bridges often present lower fees than traditional exchanges, making them a cost-effective solution for swapping assets.

What Risks Do Blockchain Bridges Face?

While blockchain bridges offer numerous benefits, they also carry notable risks:

- Centralized Theft: Trusted bridges are vulnerable to centralized theft since a single entity controls the assets.

- Cloned Websites: Scammers frequently create fake bridge interfaces to steal users’ funds. It is crucial to double-check URLs and use trusted platforms.

- Smart Contract Vulnerabilities: Bridges have become prime targets for hackers, with over $2.5 billion stolen from bridge exploits to date. A prominent example is the Ronin Bridge, which suffered a $522 million hack. This highlights the critical need for thorough smart contract auditing to identify and fix vulnerabilities before they can be exploited.

Why Use Bridges Instead of Exchanges?

Although exchanges can be used to transfer assets across chains, blockchain bridges often offer several advantages:

- Lower Fees: Swapping assets on an exchange and transferring them can be costly. Bridges provide a more cost-effective route.

- Speed: The direct transfer process on a bridge is typically faster.

- Eligibility for Airdrops: Engaging in cross-chain interactions via bridges can qualify you for airdrops, unlike using centralized exchanges.

What Are the Most Popular Blockchain Bridges?

Wormhole: One of the top bridges with a Total Value Locked (TVL) of over $288 million, supporting 18 chains, including NEAR and Ethereum.

Pros: Supports NFTs, allows redeemable tokens in case of technical mishaps

Cons: Limited to ERC-721 NFTs, relatively high fees

Across Protocol: Known for offering fast, canonical token transfers, making it highly secure.

Pros: Provides the cheapest and fastest bridge routes, no slippage

Cons: Limited to chains with canonical bridges

How to Ensure Bridge Security?

Blockchain bridges are often targeted by attackers, making their security a critical concern. Common threats include:

- Custodian Attacks: When the centralized entity or custodian holding users' assets is compromised, leading to potential asset loss.

- Communicator Attacks: Involving tampering with the communication channel or message transfers between chains, resulting in erroneous or fraudulent transactions.

- Smart Contract Exploits: Exploiters target vulnerabilities in the bridge's smart contracts to drain funds, taking advantage of bugs or logic flaws.

Check Out Our Work

We've audited top DApps and DeFi protocols, ensuring they remain secure and Free from Hacks. Check out their audit reports to see our impact.

To safeguard against these threats, it’s crucial to have your bridge audited by a reputable security firm, such as QuillAudits, which offers comprehensive reviews to identify vulnerabilities and recommend mitigation strategies. Alternatively, utilizing AI-driven tools like QuillShield can enhance security by providing automated vulnerability detection, ensuring that the bridge's smart contracts are robust and resistant to potential attacks.

Final Thoughts

Blockchain bridges are pivotal in creating a more interconnected and interoperable blockchain ecosystem. They dismantle barriers, allowing assets and data to flow freely between different networks. As blockchain technology continues to evolve, bridges will undoubtedly play a crucial role in shaping a unified, decentralized future.

The next time you're exploring the possibilities within a single blockchain, remember that a bridge can take you to the other side, expanding your horizon in the blockchain universe.

Contents