What Is Liquid Staking & How Does It Work?

Is liquid staking a game-changer? Understand the benefits, potential risks, and if it suits your crypto strategy

As the blockchain space evolves, innovative solutions like liquid staking are reshaping the way investors participate in staking and decentralized finance (DeFi).

Traditional staking locks up your assets in exchange for securing a blockchain network, but liquid staking takes it a step further.

In this blog, we’ll break down how liquid staking works, the benefits it offers, and the potential risks involved, helping you understand whether liquid staking is the right choice for your crypto strategy.

What Is Liquid Staking & How Does It Work?

Liquid staking is an evolution of traditional staking that allows you to stake your crypto assets while keeping them liquid. In essence, it lets you continue earning rewards from securing a blockchain network while using your staked assets in the decentralized finance (DeFi) ecosystem.

When you participate in liquid staking, you're issued liquid staking tokens (LSTs), which can be traded or used as collateral in DeFi protocols. These tokens represent your staked assets and retain value while your original assets remain locked in the network for staking rewards.

What Is the Difference Between Liquid Staking & Traditional Staking?

In traditional staking, your staked assets are locked up and can’t be accessed until a specified unbonding period is over.

Liquid staking, however, provides a solution to this limitation. With liquid staking, while your tokens are still locked in staking contracts, you receive LSTs that allow you to maintain liquidity.

This enables you to trade, lend, or use your tokens in other DeFi opportunities while continuing to earn staking rewards.

How Does Liquid Staking Benefit Crypto Investors?

Liquid staking offers a range of advantages that make it an appealing option for crypto investors looking to maximize their gains while maintaining flexibility. Here’s how it can benefit you:

1. Access Your Staked Assets Without Unstaking

One of the biggest challenges with traditional staking is that your assets are locked up, often for a set period, which limits their use. Liquid staking solves this by issuing Liquid Staking Tokens (LSTs), which represent your staked assets and can be traded or used in DeFi while still earning staking rewards.

This means you can stake your tokens, secure the network, and still maintain liquidity to participate in other financial activities. It’s the best of both worlds—you continue earning rewards without locking your assets away.

2. More Ways to Earn

LSTs open up new avenues for earning within the DeFi ecosystem. Whether it’s lending, borrowing, or providing liquidity in yield farming pools, LSTs allow you to generate multiple income streams. Essentially, your staked assets can work twice as hard for you—earning staking rewards while simultaneously participating in DeFi activities.

This amplifies your potential returns and makes liquid staking an attractive option for those who want to be active in DeFi without losing out on staking benefits.

3. Seamless Integration with DeFi Protocols

In the DeFi world, composability is key. LSTs are highly composable, meaning they can easily integrate into various DeFi applications. Whether it’s locking them into a collateralized debt position (CDP) or using them in prediction markets, LSTs act as building blocks that unlock various DeFi opportunities.

This flexibility allows you to maximize the utility of your assets, making liquid staking much more versatile compared to traditional staking methods where your tokens are locked and inactive.

4. Low Barrier to Entry

In traditional staking, especially on networks like Ethereum, running a validator node requires a large amount of cryptocurrency (e.g., 32 ETH for Ethereum), technical expertise, and constant maintenance. Liquid staking reduces these hurdles by offering a simple, user-friendly approach through liquid staking service providers.

These providers allow anyone, regardless of their technical know-how or the amount of crypto they own, to stake their tokens and earn rewards without needing to manage validator nodes. This democratizes staking and opens the doors to a broader group of investors who may have been previously excluded due to technical or financial limitations.

Secure Your Smart Contracts with QuillAudits

Ready to secure your smart contracts? Take the first step towards a safer blockchain journey. Request an Audit with QuillAudits today & ensure your contracts are robust and secure!

What Are the Risks Involved in Liquid Staking?

Although liquid staking offers compelling benefits, it also carries specific risks that investors must understand before diving in:

1.Validator Slashing

When you stake through a validator node, there’s a risk of slashing, which occurs when the node misbehaves or fails to perform its duties correctly. Slashing penalties can result in a portion of your staked tokens being deducted as punishment. In the context of liquid staking, you are relying on a staking provider or third-party service to run the validator.

If the validator they are using is penalized, your staked assets could be partially or entirely slashed, leading to a loss of funds. This makes choosing a reliable and reputable liquid staking provider crucial to minimizing this risk.

2. Smart Contract Vulnerabilities

Liquid staking relies heavily on smart contracts to mint, manage, and issue LSTs. While smart contracts automate these processes, they are not without risks. A bug or vulnerability in the smart contract could be exploited by hackers, leading to a loss of staked assets.

This has been a recurring issue in DeFi, where smart contract exploits have caused millions in losses across various protocols. It’s important to use well-audited and reputable liquid staking platforms to reduce exposure to these risks. Conducting a thorough smart contract security audit is a vital step in mitigating potential vulnerabilities because no smart contract is ever 100% immune.

3. LST Volatility Due To Market Risks & Price Fluctuations

Liquid staking tokens (LSTs) aren’t necessarily pegged 1:1 to the value of the underlying staked asset. Their price can fluctuate based on market demand, liquidity, and other external factors. In times of high market stress, LSTs may trade below the value of the underlying staked asset, which could lead to losses if you need to liquidate your position at a lower price.

This price volatility is an additional risk that investors need to be aware of, especially if they plan to trade or use LSTs as collateral in volatile markets.

4. Custodial Risks with Centralized Providers

If you choose to stake through a centralized liquid staking provider, such as a crypto exchange, there’s an inherent risk of custodial issues. Centralized providers take full control of your staked assets, meaning you no longer have direct control over them.

This introduces risks related to custodial breaches, exchange insolvency, or regulatory interventions that could affect your ability to access your staked tokens. In contrast, decentralized liquid staking platforms are non-custodial, but they come with the aforementioned smart contract risks.

Which Liquid Staking Protocols Are Popular in 2024?

In 2024, several liquid staking protocols have gained significant popularity, each offering unique features and advantages to crypto investors.

Here are some of the top protocols:

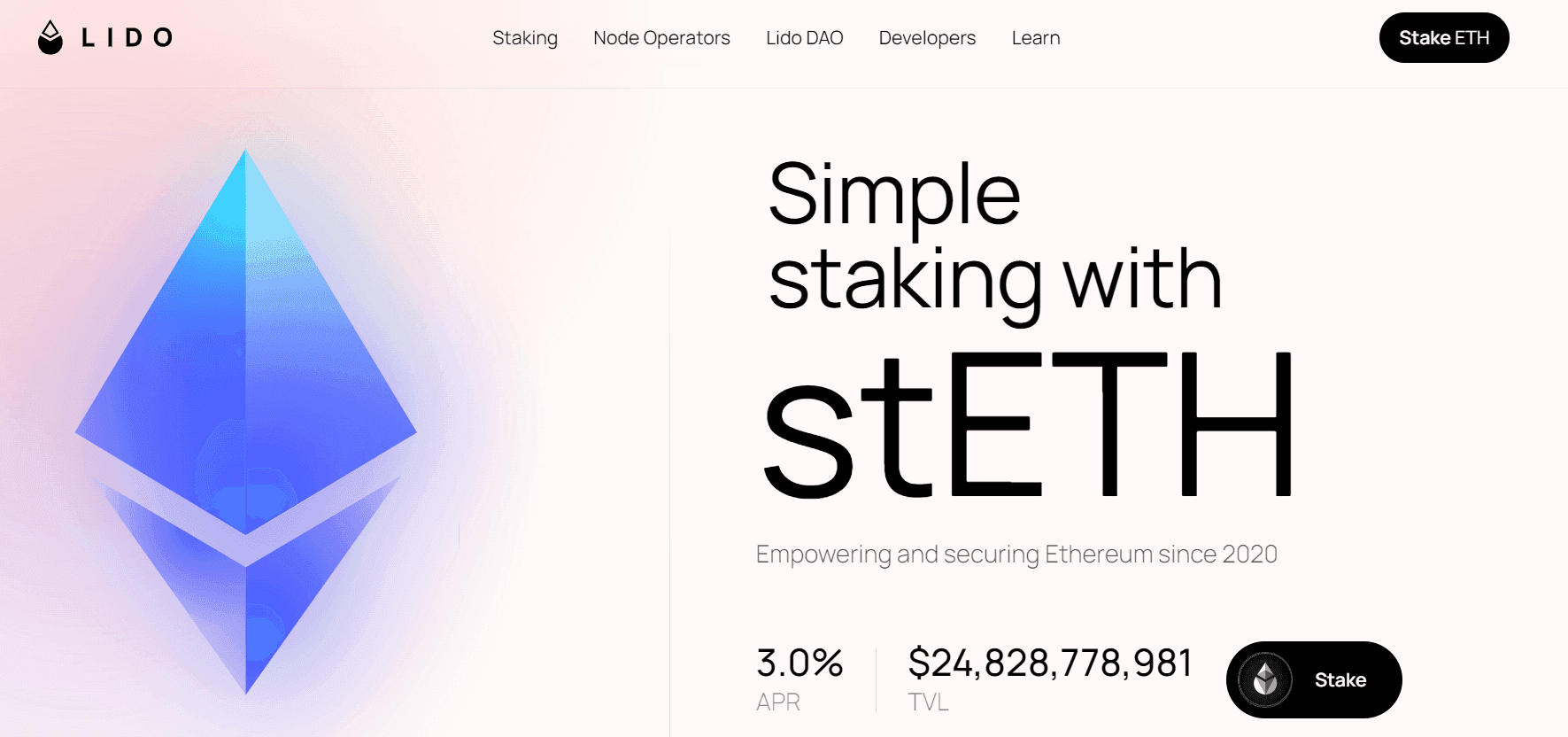

1. Lido

Lido is currently the largest and most prominent liquid staking provider, with support for multiple blockchains, including Ethereum, Polygon, Solana, Polkadot, and others. Lido has positioned itself as the go-to platform for those looking to stake their assets while maintaining liquidity in the form of liquid staking tokens (LSTs).

- Ethereum Staking (stETH): Lido’s flagship service is Ethereum staking, where users receive stETH in return for their staked ETH. stETH continues to accrue rewards and can be utilized across various DeFi platforms, including lending protocols, liquidity pools, and yield farming.

- Cross-Chain Support: Beyond Ethereum, Lido also supports Polygon (stMATIC), Solana (stSOL), and Polkadot (stDOT) staking, allowing users to access the benefits of liquid staking on multiple chains with a single provider.

- DeFi Integration: Lido has deep integrations across the DeFi ecosystem, with stETH being widely accepted on lending platforms like Aave, Compound, and Curve, as well as being used as collateral in various DeFi protocols. This composability enhances the utility of stETH and other LSTs.

2. Rocket Pool

Rocket Pool is a decentralized Ethereum staking protocol that differentiates itself by offering more accessible staking options, especially for smaller players who might not have the large amounts of ETH typically required for traditional staking.

- Minimized Entry Barrier: Rocket Pool allows users to stake as little as 0.01 ETH by using decentralized node operators to pool together smaller amounts of ETH. This makes staking more accessible to a wider audience, unlike traditional staking that may require a minimum of 32 ETH.

- Decentralized Node Operators: Rocket Pool leverages a decentralized network of node operators, meaning users are not reliant on a single centralized entity to manage their staked ETH. This decentralization helps reduce risks like censorship and slashing events.

- rETH Token: When staking through Rocket Pool, users receive rETH, which represents their staked ETH. Like other LSTs, rETH can be used in DeFi protocols to access additional income streams while still earning staking rewards.

3. Centralized Providers: Coinbase & Binance

In addition to decentralized protocols, centralized exchanges like Coinbase and Binance offer liquid staking services, providing a convenient option for users who may prefer the security and ease of use associated with trusted exchanges.

- Coinbase: Coinbase’s liquid staking service for Ethereum allows users to stake their ETH and receive cbETH (Coinbase ETH) in return. As a custodial provider, Coinbase manages the entire process, making it ideal for users who may not want to navigate decentralized platforms. cbETH can be traded or used within DeFi, although it is mostly tied to the Coinbase ecosystem.

- Binance: Binance also offers liquid staking for Ethereum and other assets like BNB (Binance Coin). Users who stake through Binance receive BETH (Binance staked ETH) or other LSTs depending on the network they’re staking on. As with Coinbase, Binance retains custody of the assets, which can be appealing to users who trust the security infrastructure of a centralized exchange.

Other Emerging Liquid Staking Protocols

- Frax ETH: This protocol combines liquid staking with algorithmic stablecoin issuance. Users who stake ETH receive frxETH, which can be used in the Frax Finance ecosystem to mint stablecoins and participate in liquidity pools. Frax ETH is becoming popular due to its innovative DeFi-native approach.

Ankr: Ankr provides staking services for multiple networks, including Ethereum, Avalanche, and Binance Smart Chain, allowing users to stake various assets and receive liquid staking tokens like aETH. Ankr focuses on Web3 infrastructure, offering decentralized node services alongside its liquid staking platform.

How Do Liquid Staking Tokens (LSTs) Work in the DeFi Ecosystem?

LSTs represent the liquidity of your staked assets and can be used within DeFi. They allow holders to participate in lending, borrowing, and liquidity pools while continuing to earn staking rewards.

Essentially, LSTs open the door to additional yield opportunities without sacrificing the rewards from securing a blockchain network.

Check Out Our Work

We've audited top DApps and DeFi protocols, ensuring they remain secure and Free from Hacks. Check out their audit reports to see our impact.

Final Thoughts

Liquid staking represents a significant evolution in the world of decentralized finance (DeFi) by allowing investors to maintain liquidity while still earning staking rewards.

By offering the ability to use liquid staking tokens (LSTs) in various DeFi protocols, it opens up additional income streams, increased composability, and the flexibility to maximize yield across the ecosystem.

Whether through decentralized protocols like Lido and Rocket Pool or centralized exchanges like Coinbase and Binance, liquid staking offers diverse options for both large and small investors.

However, it’s essential to recognize that liquid staking comes with its risks, including slashing, smart contract vulnerabilities, and the potential volatility of LSTs.

As with any investment in the crypto space, it’s crucial to do your own research (DYOR) before committing funds. Understanding the risks, security measures, and market dynamics will help you make informed decisions and maximize the benefits of liquid staking while minimizing potential downsides.

Always invest with caution & a clear strategy.

Contents