What is Hyperliquid and How Does it Work? (Explained)

Explore What is Hyperliquid, it's architecture, HyperEVM and security model to understand how it delivers high-throughput and low-latency DeFi.

Hyperliquid marks a meaningful shift in how decentralized finance infrastructure is designed, offering performance comparable to centralized exchanges while remaining fully on-chain. Built as a custom Layer 1 blockchain, it is engineered to handle over 200,000 transactions per second with sub-70ms latency, enabling high-frequency trading and sophisticated DeFi use cases.

This article is written for blockchain developers, smart contract engineers, and security researchers who want to understand how Hyperliquid works under the hood. We’ll walk through its core architecture, consensus design, smart contract model, developer tooling, and security considerations.

Why Hyperliquid? Addressing DeFi's Performance Bottlenecks

Traditional blockchains such as Ethereum face inherent constraints around throughput and latency, which limit most DeFi applications to relatively low-frequency use cases. Hyperliquid takes a different approach, designing its system around financial primitives from the outset to overcome these bottlenecks.

Unified liquidity and execution bring perpetual futures, spot markets, and smart contracts into a single shared state, removing the fragmentation typically introduced by bridges and cross-chain designs. High throughput, achieved through a pipelined consensus model, allows the network to process over 200,000 transactions per second, orders of magnitude beyond Ethereum’s <25 TPS. Low latency, with median end-to-end finality around 0.07 seconds, enables real-time trading without relying on off-chain workarounds. Finally, native composability allows smart contracts to interact directly with on-chain order books, reducing dependence on external oracles and lowering manipulation risk.

Together, these design choices address some of the most persistent challenges in DeFi fragmented liquidity, high execution costs, and slow settlement, positioning Hyperliquid as a strong foundation for institutional-grade decentralized finance.

Core Architecture: HyperBFT, HyperCore, and HyperEVM

Hyperliquid's design features a unified consensus securing two execution environments, HyperCore for native trading and HyperEVM for programmable logic. This dual-layer approach maintains a single shared state, ensuring atomic interactions without bridges.

HyperBFT Consensus Mechanism

HyperBFT, a custom variant of HotStuff, provides Byzantine Fault Tolerance (BFT) with tolerance for up to 1/3 malicious validators. It uses a leader-based model with rotating proposers and pipelined rounds to achieve low-latency finality. Unlike traditional protocols, HyperBFT overlaps proposal, voting, and commitment phases, reducing idle time.

Optimistic responsiveness enables blocks to finalize in roughly 0.07 seconds under normal network conditions, with the 99th percentile remaining below 0.5 seconds. Pipelining allows validators to process multiple blocks in parallel, significantly increasing overall throughput. Strong safety and liveness guarantees ensure the network avoids forks and continues to make progress even in the presence of faulty or malicious participants.

HyperCore: Native Trading Layer

HyperCore, implemented in Rust, is the engine responsible for managing on-chain order books for both perpetual and spot markets. It supports limit and market orders, liquidations, and funding rate calculations, all with single-block finality to ensure fast and deterministic execution.

At its core, HyperCore is composed of several key components. A Centralized Limit Order Book (CLOB) performs on-chain order matching with sub-millisecond execution. The margin engine continuously tracks open positions, calculates profit and loss, and enforces both initial and maintenance margin requirements. Complementing this, the funding mechanism applies hourly payments based on a premium index, keeping perpetual prices closely aligned with spot markets.

HyperCore also exposes its state through precompiles accessible from HyperEVM, allowing smart contracts to perform atomic reads, such as fetching real-time prices, without introducing additional trust assumptions.

HyperEVM: Programmable Layer

HyperEVM is an EVM-compatible execution environment that follows the Cancun specification (excluding blobs), allowing developers to deploy standard Solidity smart contracts without modification. By sharing state directly with HyperCore, HyperEVM enables native integrations that do not rely on external oracles, reducing both latency and trust assumptions.

Developers can continue to use familiar tooling such as Foundry and Hardhat, interacting with the network through standard RPC endpoints.

Interaction with HyperCore is facilitated through a set of precompiles. Read precompiles allow contracts to fetch on-chain data such as order book depth or mark prices, while write precompiles enable actions like submitting orders or triggering swaps through system-level contracts. Together, these primitives allow smart contracts to compose directly with the trading engine in a fully on-chain and atomic manner.

1address constant POSITION_PRECOMPILE_ADDRESS = 0x0000000000000000000000000000000000000800;

2

3function position(address user, uint16 perp) external view returns (Position memory) {

4 bool success;

5 bytes memory result;

6 (success, result) = POSITION_PRECOMPILE_ADDRESS.staticcall(abi.encode(user, perp));

7 require(success, "Position precompile call failed");

8 return abi.decode(result, (Position));

9}This avoids external oracles, mitigating flash loan attacks.

This diagram highlights the interleaved execution under single consensus.

Perpetual Trading Mechanics on Hyperliquid

Hyperliquid's primary focus is on perpetual futures (perps) trading, which drives the majority of its $300B+ monthly volumes and positions it as the leading perp DEX with over 75% market share by mid-2025. Perps are non-expiring derivatives allowing leveraged bets on asset prices without physical delivery. HyperCore implements a fully on-chain CLOB model for matching.

Key mechanics

- Order matching is handled through a fully deterministic centralized limit order book (CLOB) that supports both limit and market orders. All matching occurs on-chain with sub-millisecond latency, processing up to 200,000 orders per second. Prices are derived directly from order book depth, removing the need for external price oracles. For example, a BTC-USD buy limit order placed at $60,000 will immediately match against available sell orders if the price is crossed.

- Funding rates adjust continuously in real time and are settled on an hourly basis, based on the premium index, the difference between perpetual and spot prices. When long positions dominate, funding becomes positive, and longs pay shorts, and vice versa. Funding payments follow the standard formula: Funding Payment = Position Size × Funding Rate × Time Interval. All inputs are sourced from on-chain data, significantly reducing manipulation risk compared to TWAP-based oracle systems.

- Margin and leverage are supported across a wide range, from 20× up to 100×, with tiered margin requirements. For instance, a 20× position may require an initial margin of 5%. Positions continuously track unrealized PnL using mark prices derived from the CLOB. If a position’s equity falls below the maintenance margin threshold (e.g., 0.5%), it becomes eligible for liquidation.

- The liquidation engine operates as a fully on-chain, automated system driven by validator-like keepers. To reduce market impact, liquidations are performed partially, up to 50% of a position at a time, whenever possible. In extreme scenarios, auto-deleveraging (ADL) is triggered to rebalance the system without creating bad debt. Notably, the protocol does not charge liquidation fees, any surplus generated during liquidations is routed to the Hyperliquidity Provider (HLP) vault, benefiting liquidity providers.

For a broader overview of perp DEX architectures, including CLOB vs. AMM models and common implementations, refer to this detailed post -> Prep Dex Architecture and Security

Audit High-Performance DeFi Protocols with Confidence

Audit High-Performance DeFi Protocols with Confidence

Building on architectures like Hyperliquid demands more than standard audits. QuillAudits secures high-throughput DeFi systems with deep protocol-level security reviews before real market stress hits.

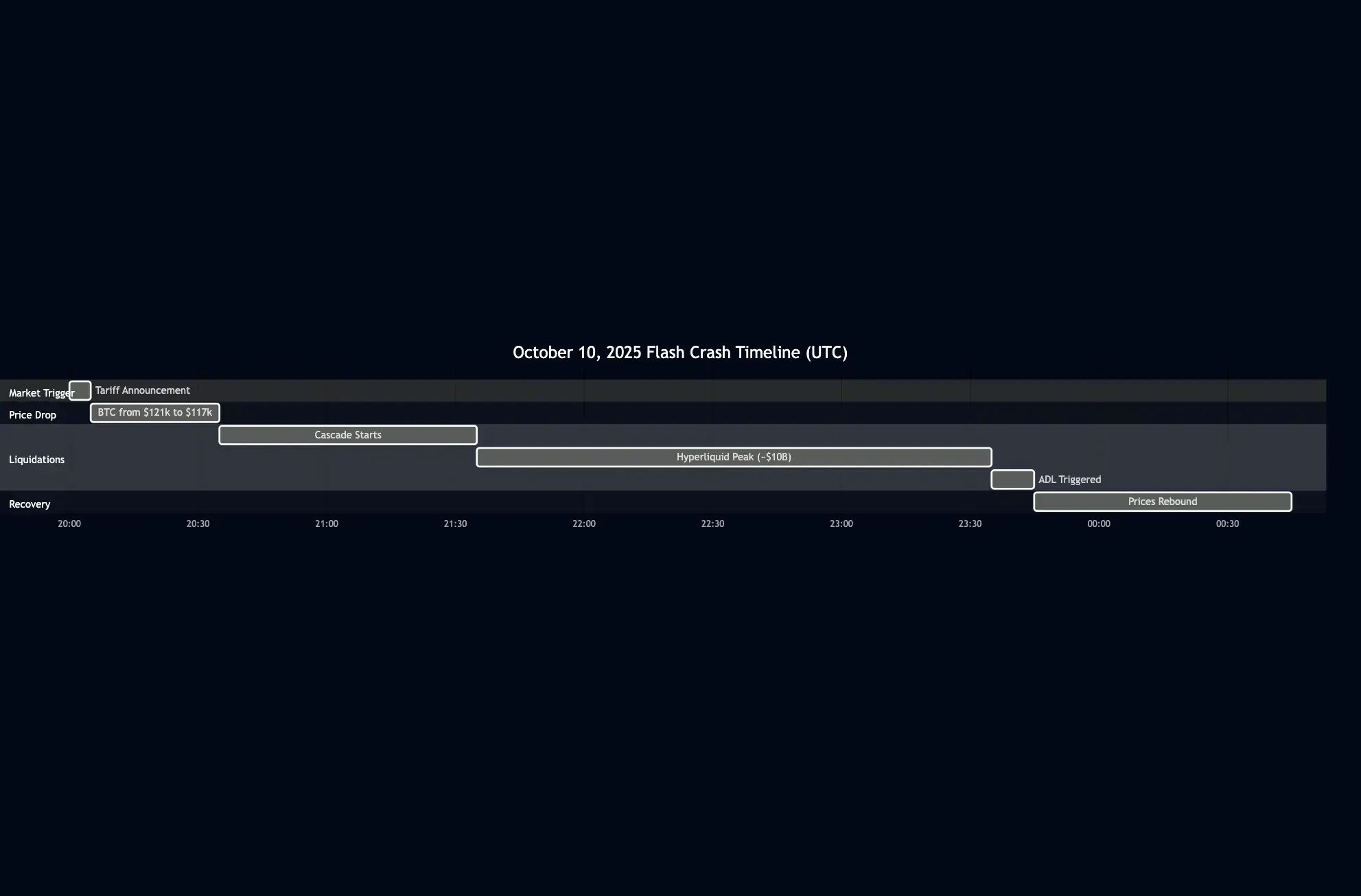

Resilience During the October 10, 2025 Liquidation Event

On October 10, 2025, the crypto market endured its largest liquidation cascade in history, triggered by geopolitical tensions (e.g., U.S. tariffs on China), causing a flash crash. Total liquidations exceeded $19-20B across venues, with 1.62M accounts affected, 87% longs. Hyperliquid handled the brunt, liquidating ~$10B (over half the global total), including a single $204M ETH position. Despite thousands of liquidations per second, it maintained 100% uptime, incurred zero bad debt, and activated ADL for the first time in years to balance positions without solvency issues.

Key metrics:

| Metric | Value | Notes |

|---|---|---|

| Total Market Liquidations | $19-20B | 87% longs, 1.62M accounts |

| Hyperliquid Liquidations | ~$10B | $16.7B longs, $2.5B shorts, 60k+ wallets impacted |

| Uptime | 100% | No outages |

| Bad Debt | $0 | On-chain engine absorbed via HLP vault (~$40M profit to LPs) |

| ADL Activation | Yes | First in 2+ years, balanced shorts at market bottom |

| Peak Throughput | Thousands/sec | HyperBFT pipelining prevented congestion |

This resilience stems from Hyperliquid's on-chain CLOB and unified state, liquidations executed deterministically without off-chain keepers or oracles, preventing delays that plagued competitors. For developers, this highlights the value of sub-second finality in stress tests, cascades amplified by leverage but contained via ADL. Security researchers note no systemic failures, though it exposed leverage risks.

Building on HyperEVM

The HyperEVM ecosystem is rapidly expanding, with projects experimenting across staking, primitives, and token design. Below are two notable efforts that highlight the breadth of innovation emerging on HyperEVM.

Kinetiq - Liquid Staking on Hyperliquid

Kinetiq is a liquid staking protocol tailored for the Hyperliquid ecosystem, enabling users to stake HYPE while retaining liquidity through its liquid staking token. By abstracting validator operations and integrating staking with DeFi composability, Kinetiq aims to improve capital efficiency without compromising on security or decentralization.

If you’re interested in how liquid staking works on Hyperliquid and the design choices behind it, read our deep dive on Kinetiq liquid staking.

Prime Numbers Labs - Prime Numbers Ecosystem

Prime Numbers Labs is building an omnichain DeFi ecosystem centered around its utility token $PRFI, combining lending/borrowing, NFT marketplaces, and novel staking models into a unified platform. At its core:

- PrimeFi - A cross-chain lending and borrowing protocol that enables users to deposit assets on one chain and borrow on another while keeping positions over-collateralized.

- PrimePort - A multichain NFT marketplace that integrates NFTs into broader financial workflows, including staking incentives.

- Staking & Rewards – Innovative staking systems where $PRFI tokens can be staked directly or used within NFT structures to earn ecosystem rewards.

Across these components, Prime Numbers Labs aims to make DeFi more accessible, interoperable, and community-centric by leveraging multichain technologies and integrated financial services.

Conclusion

Hyperliquid demonstrates that DeFi can deliver centralized-exchange performance without compromising on-chain guarantees. Its unified architecture combining HyperBFT, HyperCore, and HyperEVM enables sub-second finality, deterministic execution, and native composability at scale. The protocol’s resilience during extreme liquidation events highlights how fast consensus and fully on-chain risk management reduce systemic failure. As adoption grows, HyperEVM security becomes critical for teams building complex financial logic on top of this stack, making rigorous, protocol-aware audits essential for sustaining high-performance, resilient on-chain infrastructure.

Contents