How Kinetiq Powers Liquid Staking on Hyperliquid?

Learn how Kinetiq enables liquid staking on Hyperliquid with a breakdown of staking flow, protocol design and risk factors.

In the rapidly expanding world of DeFi, liquid staking protocols have emerged as a critical innovation, allowing users to stake native tokens while retaining liquidity for further economic activities. Kinetiq, launched in July 2025, stands out as the dominant liquid staking protocol on Hyperliquid's HyperEVM Layer 1 blockchain. If you’re new to the ecosystem, you can read more about Hyperliquid to understand how the network works.

By enabling users to stake the native HYPE token and receive kHYPE, a yield-bearing liquid staking derivative. Kinetiq has achieved remarkable traction, boasting a Total Value Locked (TVL) exceeding $639 million as of recent data, and peaking at over $2.28 billion. This positions Kinetiq as the fastest-growing LSD protocol in history, capturing over 82.5% market share in Hyperliquid's staking ecosystem.

What is Kinetiq?

Kinetiq is a liquid staking protocol natively built on Hyperliquid's HyperEVM, an EVM-compatible Layer 1 optimized for high-throughput DeFi applications. Its flagship product, kHYPE, allows users to stake HYPE (Hyperliquid's native token) and receive an equivalent liquid token that accrues staking rewards automatically through compounding validator yields. This eliminates the traditional trade-off between staking for network security and maintaining asset liquidity.

Key Features and Objectives

- Liquidity and Composability: kHYPE can be used as collateral in lending protocols like Hyperlend, traded in AMMs, or deployed in yield optimizers like Pendle, where it has attracted over $40 million in TVL within weeks of integration.

- Autonomous Validator Management: Via StakeHub, Kinetiq automates validator selection, delegation, and rebalancing based on performance metrics, reducing user friction and risks.

- Reward Mechanism: No rebasing; rewards are reflected in an appreciating kHYPE/HYPE exchange rate, avoiding tax complexities.

- Institutional Focus: Features like iHYPE cater to institutional staking with enhanced custody rails.

- Ecosystem Growth: Kinetiq supports Hyperliquid's broader ambitions, including HIP-3 (builder-deployed perpetuals), where it provides staking capital through its "Launch" Exchange-as-a-Service (EaaS) product.

Kinetiq is deeply integrated with Hyperliquid's Layer 1 infrastructure, utilizing features like CoreWriter Contracts to communicate directly with validators and efficiently manage staking operations.

Architecture Overview

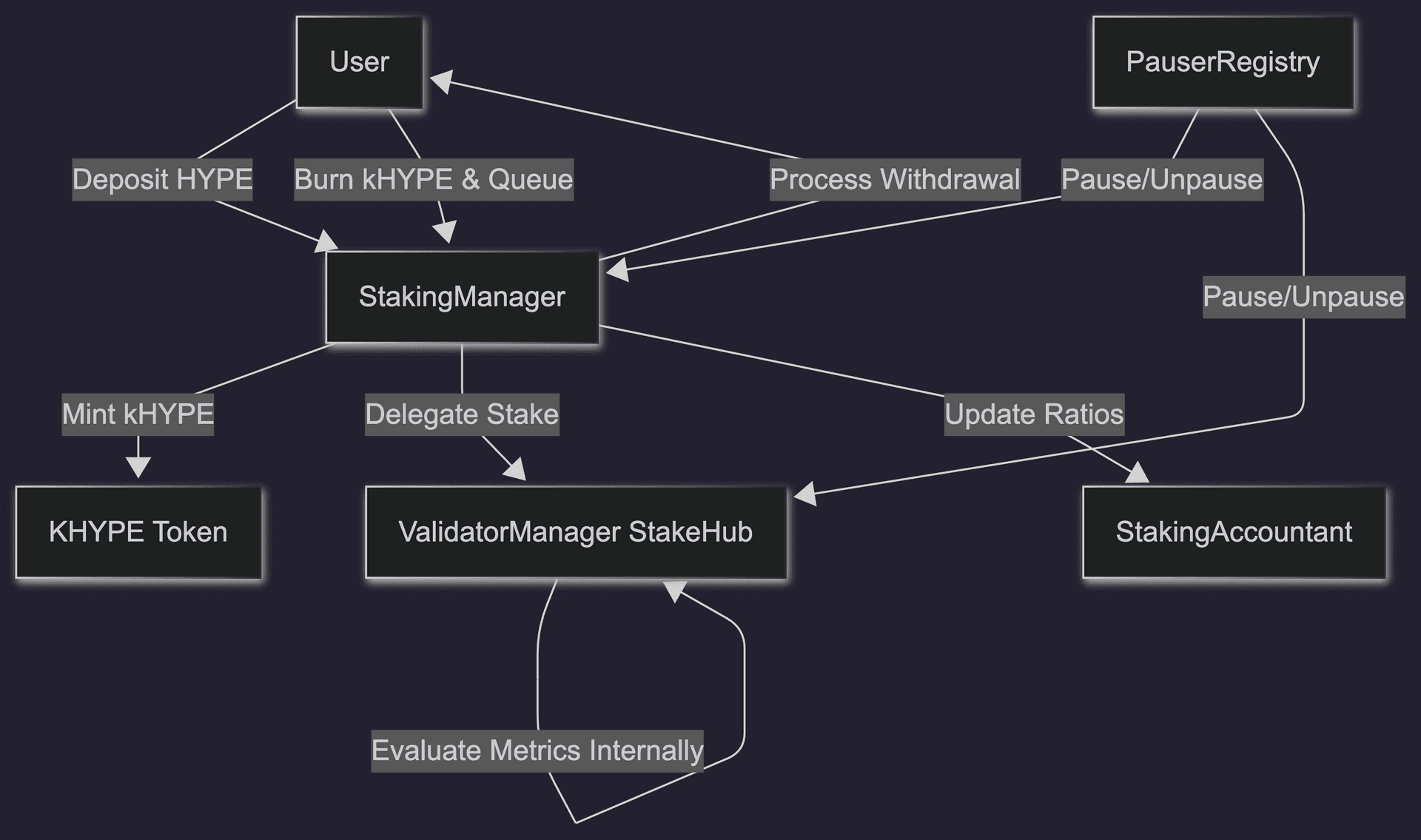

Kinetiq's architecture is modular, comprising smart contracts for staking, accounting and validator management. It leverages HyperEVM's EVM compatibility for seamless deployment in Solidity. The core components interact as follows:

This diagram illustrates the high-level flow. Users interact primarily with StakingManager, which coordinates token minting/burning, stake delegation via StakeHub (ValidatorManager), and global accounting (StakingAccountant). Validator metrics are evaluated internally through Hyperliquid's integrated systems.

How Does Kinetiq Work?

Kinetiq's workflow is designed for efficiency, security, and transparency. Let's break it down step by step, incorporating code samples from contracts.

Staking Process

Users deposit HYPE into the StakingManager contract, which mints kHYPE at a 1:1 ratio (adjusted for rewards over time). The staked HYPE is then delegated to validators via StakeHub.

1function deposit(uint256 hypeAmount) external {

2 require(hypeAmount > 0, "Zero amount");

3 // Transfer HYPE from user (assumes HYPE is an ERC-20 on Hyperliquid)

4 // IERC20(HYPE).transferFrom(msg.sender, address(this), hypeAmount);

5

6 uint256 khypeAmount = accountant.calculateKHYPEAmount(hypeAmount);

7 khype.mint(msg.sender, khypeAmount);

8

9 emit Deposited(msg.sender, hypeAmount, khypeAmount);

10}This function calculates the kHYPE amount using the global exchange rate from StakingAccountant and mints via the KHYPE token contract.

StakeHub: Validator Management

StakeHub (ValidatorManager.sol) autonomously selects and manages validators using performance scores (e.g., uptime, slashing history). Stakes are diversified to mitigate risks, with rebalancing triggered by underperformance. Metrics are fetched via Hyperliquid's built-in systems, without external oracles.

1function allocateStake(address validator, uint256 amount) external {

2 require(stakes[validator] + amount >= MIN_STAKE, "Below min stake");

3 stakes[validator] += amount;

4 emit StakeAllocated(validator, amount);

5}Scores are updated internally, and rebalancing redistributes stakes:

1function rebalance(address[] calldata validators, uint256[] calldata amounts) external onlyRole("MANAGER_ROLE") {

2 // Logic to withdraw from underperformers and allocate to top ones

3}StakeHub's scoring algorithm weighs factors like commission rates and historical yields, ensuring >5% of total network stake is managed efficiently.

Reward Accrual

Rewards from Hyperliquid validators (block production, fees) are compounded into the kHYPE value. Data is aggregated via integrated Hyperliquid mechanisms.

1function applyReward(address validator, uint256 reward) external onlyRole("MANAGER_ROLE") {

2 // Increase stake in ValidatorManager

3 // accountant.increaseStakedHYPE(reward);

4 emit RewardDistributed(validator, reward);

5}Unstaking Process

Users burn kHYPE and queue withdrawals with a security delay to prevent exploits. Funds are drawn from a HYPE buffer.

1function queueWithdrawal(uint256 amount) external {

2 queuedWithdrawals[msg.sender] += amount;

3 emit QueuedWithdrawal(msg.sender, amount);

4}

5

6function processWithdrawals() external {

7 uint256 totalQueued = queuedWithdrawals[msg.sender];

8 // Pull from hypeBuffer and burn kHYPE

9 khype.burn(msg.sender, accountant.calculateKHYPEAmount(totalQueued));

10 // Transfer HYPE to user

11 queuedWithdrawals[msg.sender] = 0;

12 emit Withdrawn(msg.sender, totalQueued);

13}

DeFi Composability and Integrations

kHYPE integrates natively with Hyperliquid's DeFi stack, including Pendle for yield tokenization, Curve for liquidity pools, and upcoming HIP-3 markets for leveraged perpetuals. This enables strategies like borrowing against kHYPE or farming additional yields, boosting overall APY.

Integration with Hyperliquid

Kinetiq is engineered as a native extension of Hyperliquid, leveraging its Layer 1 features for superior performance and interoperability. This integration utilizes Hyperliquid's HyperEVM for EVM-compatible smart contracts, enabling seamless staking and DeFi composability.

Native L1 Advantages

- Direct Validator Communication: Kinetiq interacts with Hyperliquid's validator set via CoreWriter Contracts (formerly Write Precompiles), allowing permissionless staking management and real-time delegation.

- Batch Operations: Staking and delegation are batched to reduce gas fees, capitalizing on Hyperliquid's high-throughput design with sub-second finality.

- State Synchronization: Kinetiq syncs staking states on-chain, ensuring transparency and auditability across HyperCore (the core engine) and HyperEVM.

- Security Inheritance: By building on Hyperliquid's base layer, Kinetiq inherits its consensus security, slashing protections, and economic models.

- Cross-Chain Functionality: Supports swaps from Ethereum or Base for acquiring kHYPE directly on HyperEVM, enhancing accessibility.

Technical Synergies

Kinetiq leverages Hyperliquid's Read Precompiles for querying staking data and CoreWriters for executing delegations, bridging the DEX, staking system, and governance modules. This enables kHYPE to be used as margin in perpetual futures or options on Hyperliquid's decentralized exchange primitives. Integrations extend to protocols like Curve, Pendle, Hyperlend, and Felix, where over $180 million in kHYPE collateral has been deposited.

In essence, Kinetiq amplifies Hyperliquid's staking economy by making it more accessible and liquid, driving higher TVL and network participation. Its evolution into an "Exchange Factory" via HIP-3 further embeds it as core infrastructure.

Conclusion

Kinetiq transforms staking on Hyperliquid from a passive security mechanism into a dynamic, liquid asset class. Through its StakeHub engine and native integration, it simplifies participation while supporting the broader goal of Securing HyperEVM. For developers, it's a building block for innovative dApps; for users, it's a gateway to efficient capital deployment.

Contents