Real World Assets Handbook

Welcome to the comprehensive guide to bringing real-world assets on-chain, covering token standards, custody mechanics, ecosystem architectures, and global regulatory requirements.

This handbook is designed to provide you with a clear, structured, and comprehensive understanding of how RWA systems are built, operated, and regulated.

What You Will Learn?

Ecosystem Landscape

A clear breakdown of the major RWA players and how they work, without marketing fluff.

You’ll learn:

- What each RWA protocol tokenizes

- Their architectural models (vaults, SPVs, tranching, compliance layers)

- How off-chain systems interact with smart contracts

- What developers should learn from each design

This section gives you a real-world mental model of how today’s leading RWA platforms operate.

Regulatory Mapping

RWAs require compliance frameworks, not just code. This section simplifies global compliance into three easy formats:

- Region-wise Rules: U.S., EU, Singapore, Hong Kong/Asia, plus global standards

- Asset-type Mapping: which rules apply to treasuries, private credit, securities, real estate, commodities, etc.

- Founder Checklist: SPVs, custodians, licensing, disclosures, investor verification, tax + data requirements

Disclaimer: This section offers guidance, not legal advice. Always consult qualified legal counsel for compliance decisions.

This is the practical regulation guide every builder wishes they had.

Developer Foundation

Build a deep understanding of:

- Tokenization Standards used in RWA systems: vaults, permissioned tokens, bonds, structured products, semi-fungible assets

- Stablecoin & RWA-backed Architectures: issuance flows, custodians, NAV, audits, peg mechanics

- System Design Patterns: mapping SPVs, custodians, KYC, attestations, and settlements into on-chain logic

These chapters are practical, implementation-oriented, and tailored for developers, auditors, and protocol engineers.

Who This Handbook Is For?

This handbook is designed for:

- Smart contract developers

- Blockchain security researchers

- Protocol architects

- Founders building RWA ecosystems

- Auditors analyzing permissioned-token systems

You’ll benefit the most if you already understand Solidity, token standards, and DeFi basics.

Why RWAs Matter?

RWAs are the foundational bridge between traditional financial markets and programmable digital infrastructure. Unlike pure DeFi assets, they represent real legal claims, audited cash flows, and regulated ownership rights, bringing credibility, yield, and institutional liquidity on-chain.

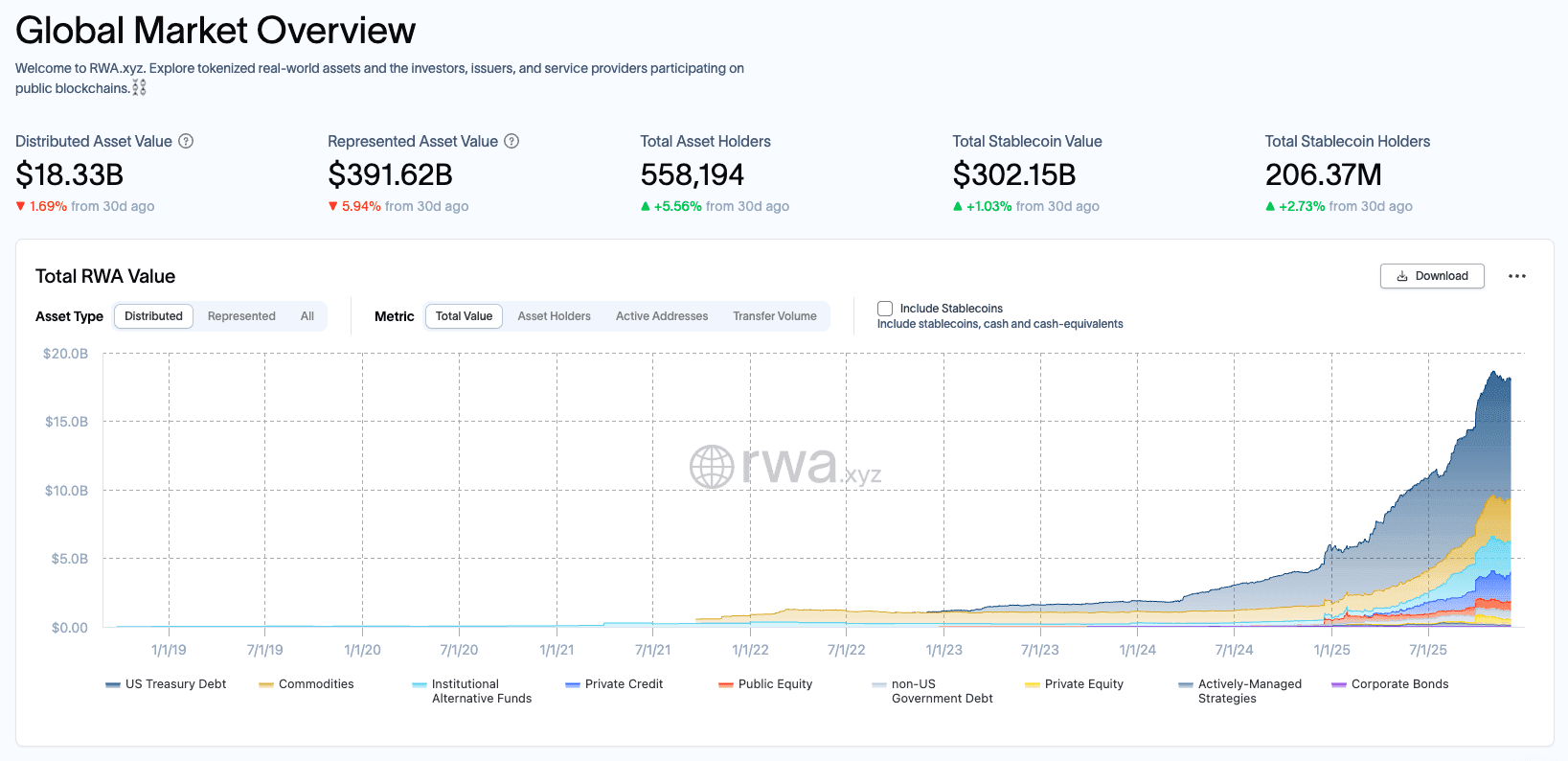

Market Signals

- $18.33B in tokenized assets deployed on-chain

- $302B+ stablecoin value acting as settlement and liquidity rails

- 206M+ holders - broad, mainstream exposure

- Continuous upward growth since 2023 → institutions moving from pilots to scale

RWAs matter because they introduce what crypto alone could not:

- Regulated exposure to treasuries, private credit, funds, real estate, and commodities

- Transparent yield backed by verifiable collateral, not incentive emissions

- Programmable compliance (KYC, transfer permissions, attestations)

- Interoperable liquidity across banks, stablecoins, custodians, and on-chain venues

They transform blockchains into financial infrastructure, not just trading environments.

RWAs move capital markets from static ledgers and intermediaries to 24/7 settlement, shared proofs, automated compliance, and globally open participation.

This handbook equips you to understand that shift, how RWA protocols are built, how assets are held and verified, and how regulation, settlement, and token mechanics come together on-chain.

Industry Perspective

The future of DeFi belongs to yield you can verify. Investors want yield opportunities combined with asset transparency and compliant infrastructure. They want manageable risk. That’s why RWAs are surging and why the market is on pace to reach $50–60 billion in 2026. Platforms like Plume that put trust, compliance, and transparency at the core will be the ones that scale to meet mainstream demand.

- Teddy Pornprinya, Co-Founder Plume Network

As assets become digital and borders fade, tokenization gives every investor the ability to participate in opportunities once reserved for institutions. This is the foundation of a more open and equitable financial future.

- Abdul Rafay Gadit, Co-Founder ZIGChain

Institutional adoption of RWAs on BNB Chain has gained strong momentum in 2025. With the launch of VanEck’s VBILL fund, BlackRock’s BUIDL fund, and Franklin Templeton’s BENJI fund on the network, the RWA ecosystem has expanded from roughly $5 million to $1.5 billion — a remarkable milestone and an unprecedented pace of growth for BNB Chain. - Ben, BNB Chain, GTM and Ecosystem Growth

- Ben W., RWA Head BNB Chain

We’re now at the point where tokenised assets become truly usable ie lower barriers, higher access, and financial tools that were once exclusive now open to everyone.

- Aishwary, Global Head RWA Polygon

Within five years, tokenisation will become the primary mechanism for raising and deploying capital globally. The winners will be the platforms that balance regulatory assurance with the flexibility of open blockchain infrastructure.

- Scott Thiel, Co-Founder and CEO of Tokinvest

From an infrastructure standpoint, the biggest unlock for RWAs is interoperability not between chains, but between the real-world processes that sit behind them. Custody, identity, compliance, issuance, and settlement must function as a single coordinated system. At Tokinvest, we’ve focused on building rails that integrate fiat settlement, regulatory controls, and on-chain yield distribution. The next phase is enabling multiple partners to plug into a common token standard and distribution network so that RWAs can move as fluidly as digital assets.

- Matt Blom, CSO and Co-Founder of Tokinvest

How to Use This Handbook?

- Start with the Ecosystem Landscape to understand how leading RWA platforms design and run their systems

- Refer to the Regulation Mapping to map compliance requirements to your asset type and jurisdiction

- Use the Developer Foundation to learn standards, architectures, and off-chain integrations

- Treat this handbook as a living guide and reference for building or auditing real-world asset protocols